Token Bonding Curves: How do they work?

Token bonding curves are a math function that determines the price of a token based on its supply, allowing for a decentralized way to regulate token prices and creating unique token models with different incentive mechanisms.February 25, 2023

Today, we're going to talk about token bonding curves and why they're so awesome. But don't worry, we won't bore you with dry technicalities.

So, what's a token bonding curve, you ask? Check our previous article here Token Bonding Curves: Understanding the Basics

One of the coolest things about token bonding curves is that they can be used to create decentralized exchanges and (LP) token minting. The smart contract takes care of all the pricing, so no one gets to decide how much to mint at what price. It's all done automatically, which is super convenient.

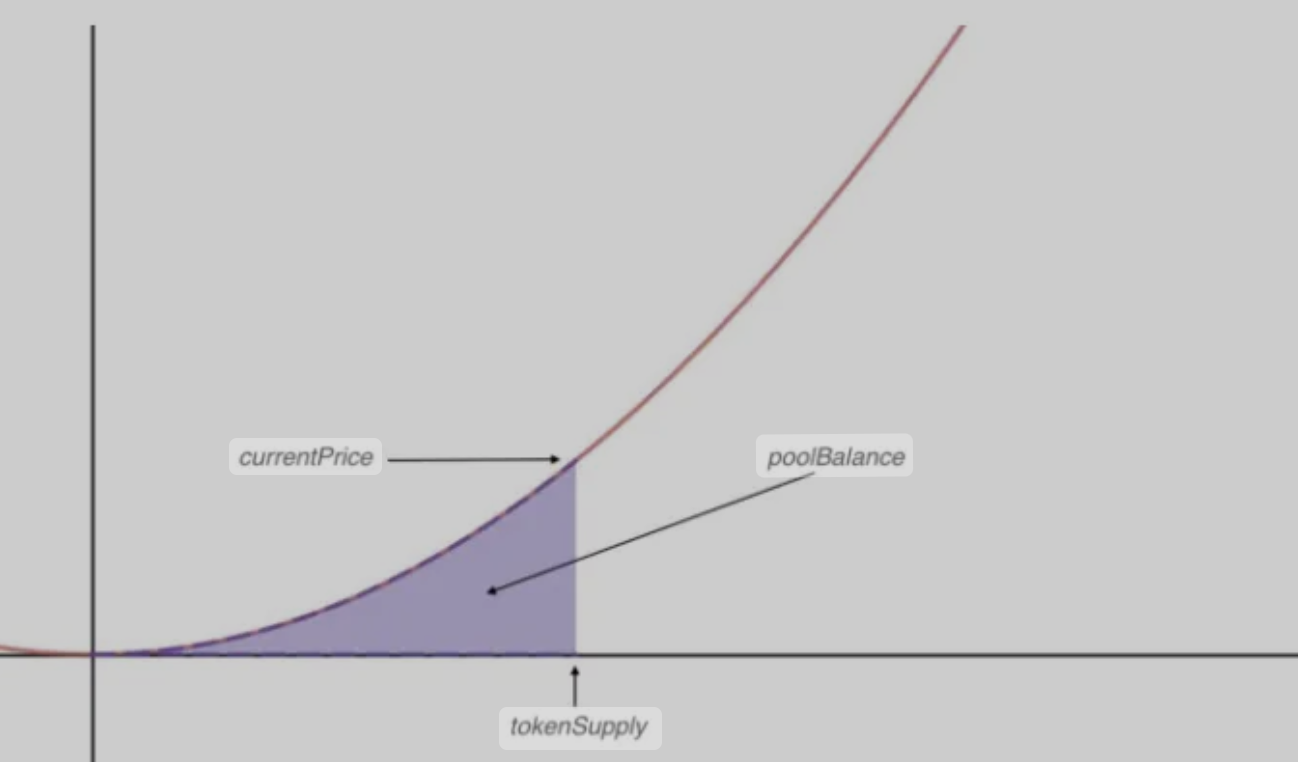

Another great thing about token bonding curves is that the price increases as the token supply grows. This shows that the ecosystem is gaining more economic value, which is always a good thing. Plus, it's a great way to correlate economic value increase with monetary value. So, when there are more tokens out in the market, the price increases because more people believe in the project and are buying and using the tokens. It's a win-win situation!

There's more! Money is kept in a smart contract as a reserve pool or collateral, which gives value to the token pricing. This collateral is transparently tracked and accounted for, which reduces bribery, increases transparency, and makes everything more accountable. And, if someone wants to burn their tokens, they get to keep part of the collateral back. Plus, the collateral is not dependent on how much was put in initially, but rather on the curve itself. So, you reduce the chances of scams and increase trust in the system.

Now that we've covered the basics of token bonding curves, let's talk about some of the ways they can be used. There are different incentive mechanisms that can be embedded in the math function to create unique token models.

For instance, you can have instant liquidity, which is amazing. Instead of having a market maker or taker filling up the books, it's all done automatically with a math function. You can also have continuous minting and burning, which eliminates the need for governance pools to decide how much to burn or mint based on quarterly results. Everything is automated and defined with math!

Another incentive mechanism is the bid-ask spread, which generates income from liquidity. This is where the buy and sell curves come into play. The difference between the two curves generates profits that go back into the ecosystem and can be distributed to token holders as a reward for holding the tokens. It's a win-win!

And, if you want to reduce pump and dump schemes, you can change the curve's gradients to affect the incentive mechanisms in place. You can also embed different kinds of economic and governance rules to suit your needs.

Token bonding curves are also a way to create a decentralized ecosystem that's fair and transparent for everyone involved. They allow for anyone to participate and have a say in the value of the token. And, they can create an incredible network effect that drives economic value and innovation.

Let's build a better future together with decentralized applications that use bonding curves. Contact us for more informmation.

inspired by: Token Valuation with Token Bonding Curve